Welcome to the Diocesan Development Fund (DDF), where we are excited to help you simplify and streamline your organisation’s finances. Our mission is to provide financial services that promote the continued growth and development of a vibrant and evangelising Catholic Church in the Diocese of Parramatta. As your trusted partner, we offer a range of products and services to support your daily finance needs. Whether you’re a parish, school, agency, religious congregation, or clergy member in the Catholic Diocese of Parramatta, we are here to assist you.

Please note the products and services offered by the DDF are only available to Catholic organisations operating within Australia.

Financial Services

Loans

Looking to embark on a new construction project, renovation, or purchase of land? Our competitive loans are designed to meet your unique needs. With flexible terms, conditions and no fees, we provide variable interest rates and allow lump sum repayments and redraws without penalties for loans up to 20 years.

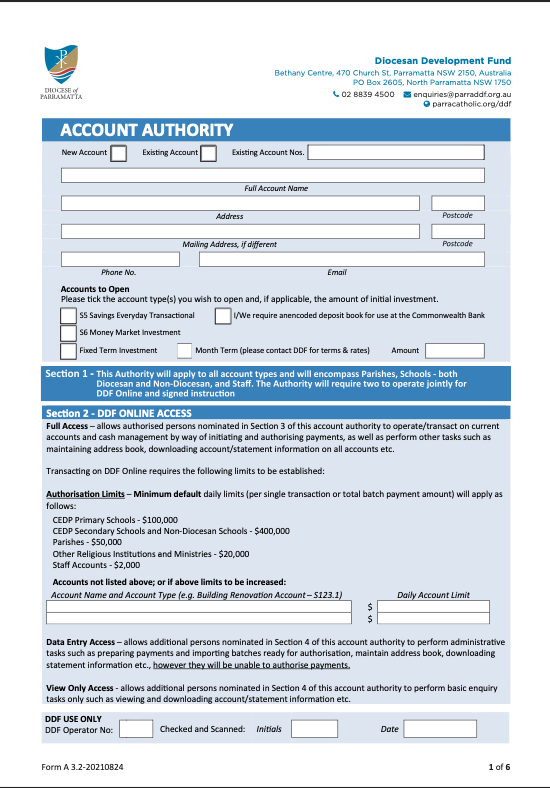

Business Everyday Account

Our Business Everyday account not only helps you manage transactions, it also earns interest on credit balances. It also has features such as DDF Online access, direct debits, and over-the-counter deposits at Commonwealth Bank branches.

DDF Online

Access your accounts and perform transactions from anywhere with DDF Online. This reliable platform allows you to view all your DDF accounts in one place, upload creditor files for bulk payments, pay by BPAY and EFT, download statements, create future payments, and much more.

Online Money Market

If you’re seeking a better return on your cash surpluses while maintaining on-demand access to your funds, our Online Money Market account is the solution. With daily interest calculation and the ability to move funds between accounts or financial institutions via DDF Online, you can maximise your returns without sacrificing liquidity.

Fixed-Term Investment

This is ideal if you need a secure investment with guaranteed interest rates over a fixed term. Fixed-Term Investments are designed for those who do not require immediate or regular access to their funds and want the assurance of a stable interest rate throughout the specified term.

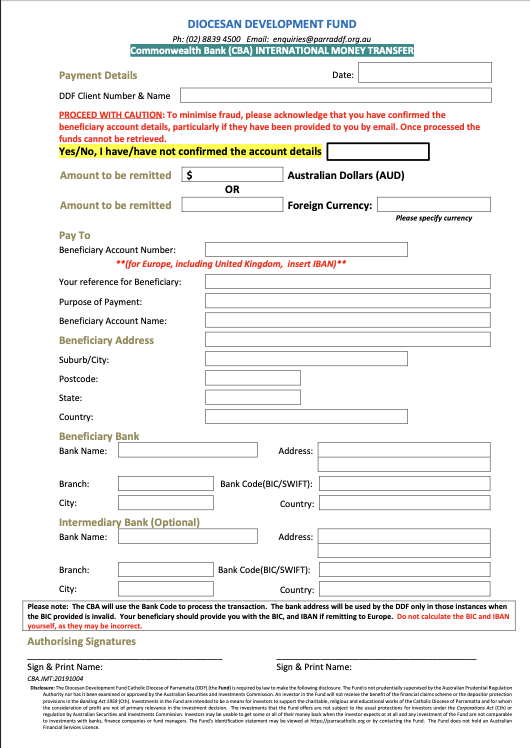

International Money Transfers

If you require international money transfers, we can facilitate this on your behalf using the services of the Commonwealth Bank of Australia. Trust us to handle your international financial transactions securely and efficiently.

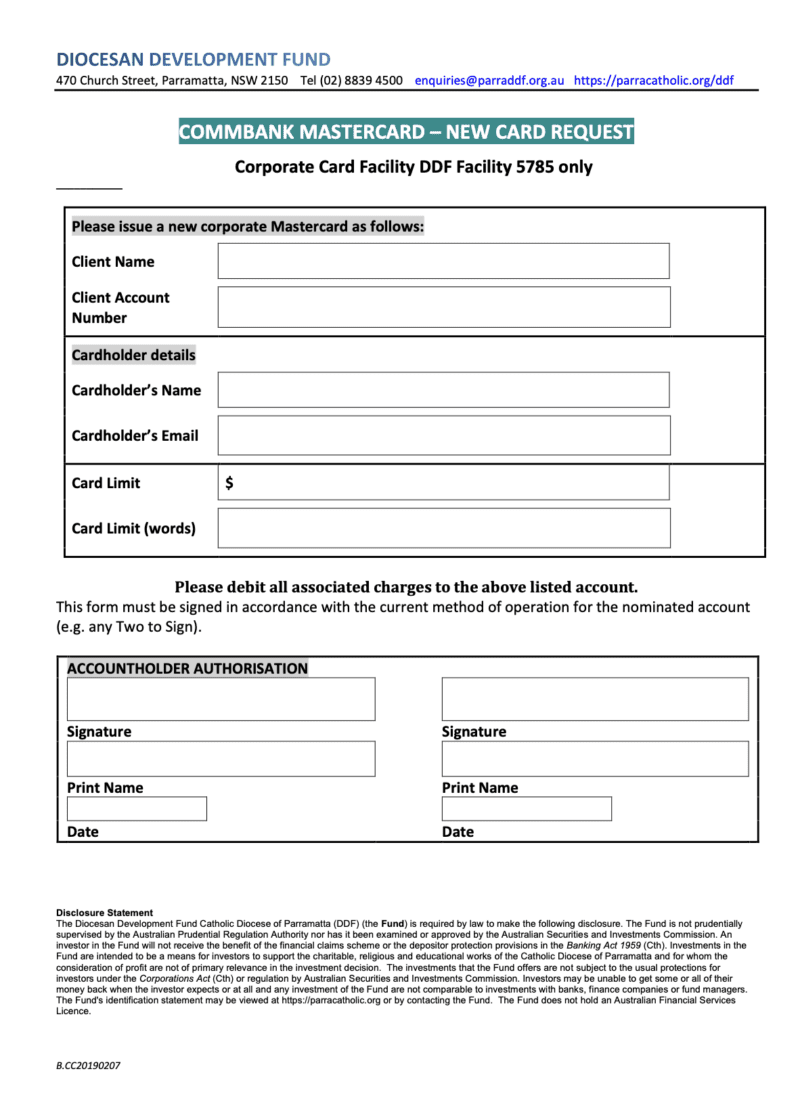

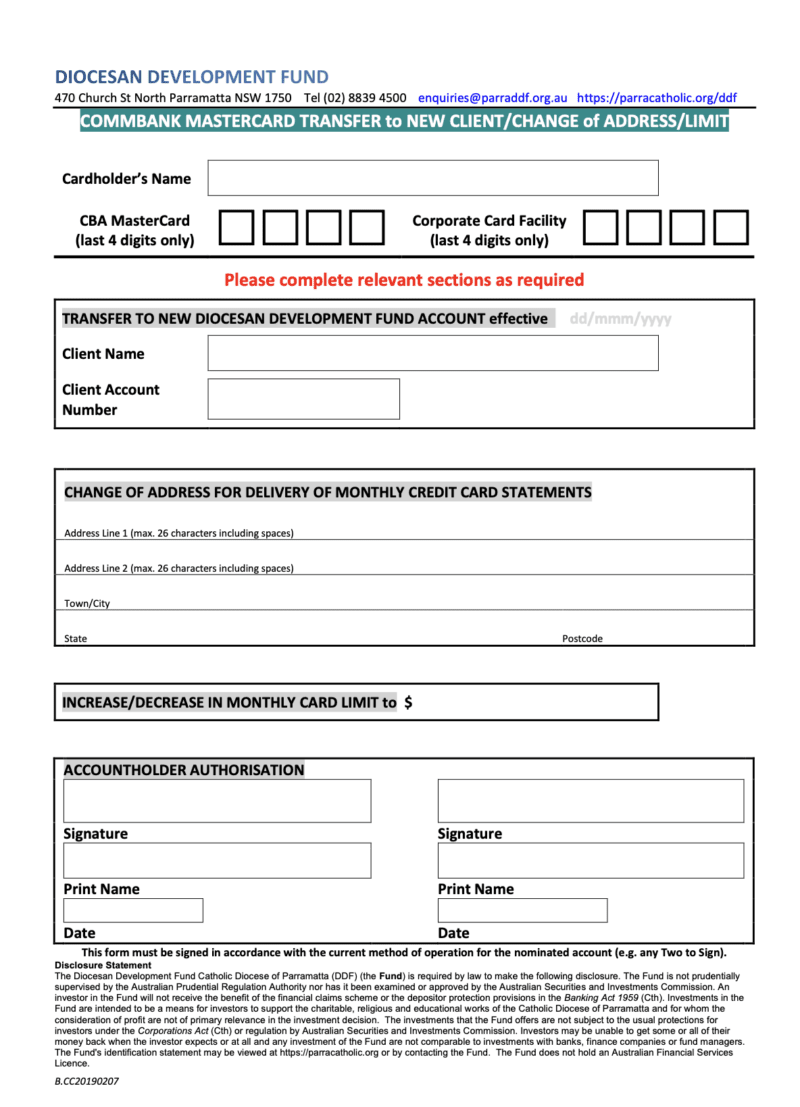

Corporate Credit Cards

Having a corporate credit card facility will enable you and your employees to make regular payments in-store, online and over the phone anywhere that MasterCard is accepted.

For more information about our services, please contact the DDF Office on (02) 8839 4500 or complete the form below

Merchant Services

We have developed a long-standing relationship with the Commonwealth Bank of Australia (CommBank) and are able to negotiate discounted pricing for clients for whom we facilitate access to CommBank’s products and services.

CommBank Smart Terminal and Donation App

This user-friendly Donation App has been exclusively designed for the Catholic Church Australia and comes pre-loaded on the Smart Terminal. You can effortlessly accept donations and process EFTPOS payments in one convenient device. Simply choose or customise the donation amount, and seamlessly handle payments with ease. The Smart Terminal can be used on a stand or as a mobile device, providing flexibility for your needs.

Please note that Commonwealth Bank fees apply. Contact the DDF office for the current discounted fee schedule.

CommBank Smart Mini Reader

Smart Mini is a compact and portable payment device that allows you to process quick and secure transactions wherever your customers are.

Commonwealth Bank fees apply. Contact the DDF office for the current discounted fee schedule.

Please note that Commonwealth Bank fees apply. Contact the DDF office for the current discounted fee schedule.

Qkr by Mastercard for Schools and Parishes

Designed specifically for schools and parishes through our partnership with CommBank, Qkr allows parents and parishioners to make payments for various services through customisable payment pages for ongoing or one-off events.

Available on desktop and mobile for Apple and Android users, the Qkr app allows convenient payments at any time.

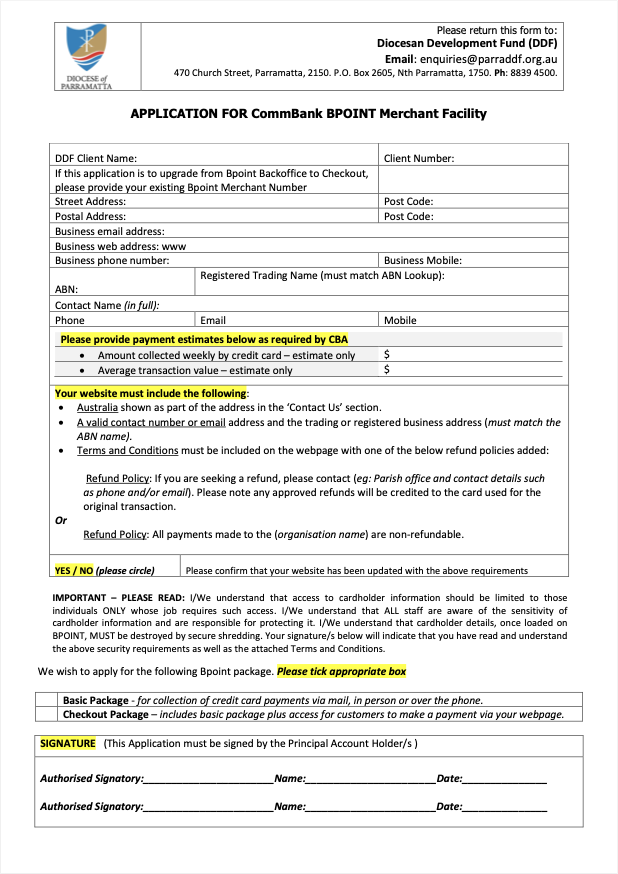

Commbank BPOINT

With BPOINT, you can process one-off payments, batch payments, and refunds, as well as schedule recurring payments while giving individuals the convenience of using their debit or credit cards.

As a valued DDF client, you have the opportunity to take advantage of discounted pricing through our partnership with CommBank by setting up a BPOINT merchant account. Choose the BPOINT facility that suits your needs:

QUEST Donation Point Tap terminal

This is a user-friendly, portable contactless payment terminal designed for electronic donations from anywhere. It features a compact design with a 3.5″ colour touchscreen, a 4G mobile connection and a rechargeable lithium-ion battery. It offers various accessories for versatile donation options, including credit or debit cards and smart devices.

Please note that Quest fees and CommBank Merchant fees apply. Contact the DDF office for the current fee schedule.

For more information about our services, please contact the DDF Office on (02) 8839 4500 or complete the form below

DDF Office:

Bethany Centre

470 Church St

Parramatta NSW 2150

Phone: 02 8839 4500

Opening Hours:

8:30am – 4:30pm

Monday to Friday

DDF Postal Address:

PO Box 2605

North Parramatta

NSW 1750

Invest with a team that loves to share

We pride ourselves on understanding the unique needs of the Church and delivering exceptional, personalised service. Our team is committed to continuously improving our products and services to cater to the diverse areas within the Church community.

Since our establishment, the DDF has proudly provided over $530 million in loans, and our clients’ transactional and investment accounts hold approximately $650 million. Our investments, carefully managed, contribute to the growth of the Church and generate income while ensuring that our clients receive competitive interest rates on their funds.

At the DDF, we are committed to stewardship and transparency. Our surplus funds are diligently allocated to further the vital mission of the Church. Annually, these resources are directed to the Diocesan Chancery, empowering the Bishop’s pastoral priorities and ministry programs, which serve the faithful and strengthen our community.

By investing with us, you not only gain access to a range of comprehensive financial products and services but also contribute directly to the growth and mission of the Church. We are proud to be part of this journey, supporting the vibrant Catholic community with professionalism, integrity, and a deep understanding of our shared values.

Join us in shaping the future of the Church through responsible and purpose-driven service. Together, we can make a difference and support the important work of the Church in our lives and communities.

Contact us today to explore how the DDF can support your financial needs and join us in our mission of service to the Catholic Church. Please note that all credit facilities and products are subject to approval

Who we serve

The Diocesan Development Fund Parramatta exclusively services a range of Catholic Entities including Parishes, Schools, Agencies, Chaplaincies, Religious Institutes, Clergy and any entity that falls within the definition of an “Associate” under the Corporations Act 2001 (Act) Exemption Instrument 2016/813 (Wholesale Charitable Investment Fundraising) and an “Affiliate” under the Banking Exemption No. 1 of 2017 of the Banking Act 1959.

The Diocesan Development Fund Parramatta does not and will not offer, issue or sell products to individual retail investors who are not Associates and Affiliates, and as such, its products are not retail products and are therefore not available to the general public.

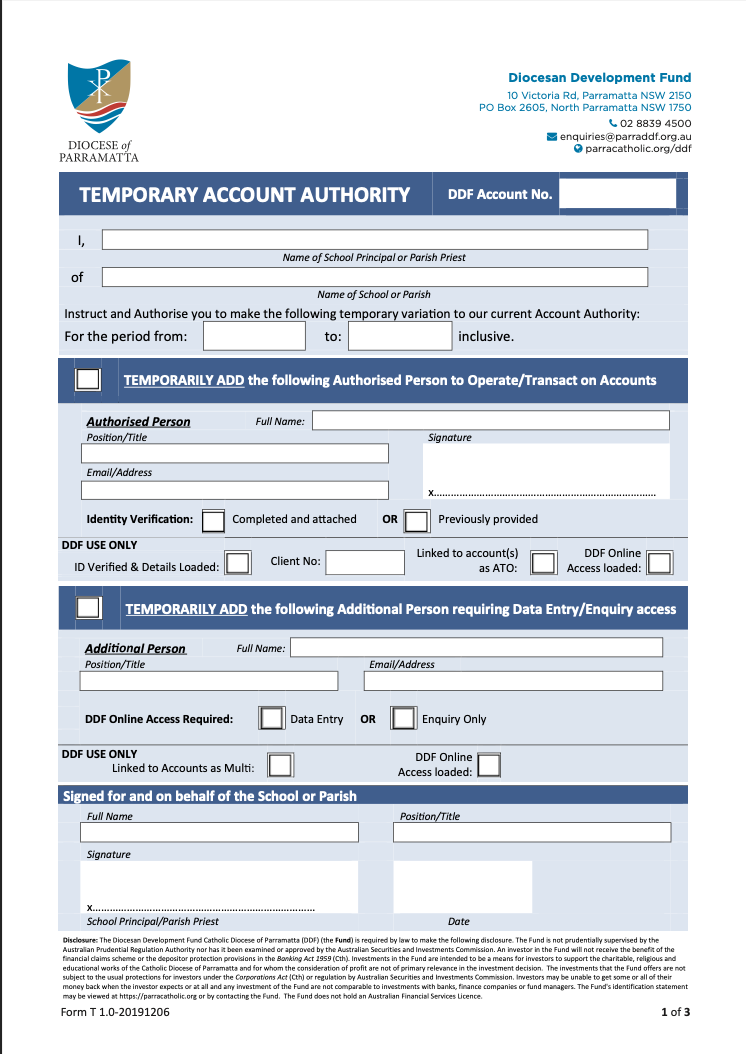

Forms

ASIC Identification Statements

Disclaimer

The information on this site is provided in good faith by the Diocesan Development Fund Catholic Diocese of Parramatta (DDF). Information on this site may be changed without notice.

The DDF provides no warranties, representations or assurances that the information contained on this site or any linked sites is current, up-to-date, complete or accurate. Users of this website do so at their own risk.

Any advice provided on this website does not take into consideration your objectives, financial situation or needs, which you should consider before acting on our information. You should read and consider our Disclosure Statement before deciding whether to acquire any product or service.

Before relying on any information on this site or any linked sites, users should make their own inquiries to the relevant organisation.

The DDF expressly disclaims all liability and responsibility for any information on this site (whether express or implied) or any linked sites or for any damage to a user’s computer, software or data as a result of or in connection with the user’s access to this site or to any site linked to this site.

Disclosure Statement

The Diocesan Development Fund Catholic Diocese of Parramatta (DDF) (the Fund) is required by law to make the following disclosure. The Fund is not prudentially supervised by the Australian Prudential Regulation Authority nor has it been examined or approved by the Australian Securities and Investments Commission. An investor in the Fund will not receive the benefit of the financial claims scheme or the depositor protection provisions in the Banking Act 1959(Cth). Investments in the Fund are intended to be a means for investors to support the charitable, religious and educational works of the Catholic Diocese of Parramatta and for whom the consideration of profit are not of primary relevance in the investment decision. The investments that the Fund offers are not subject to the usual protections for investors under the Corporations Act (Cth) or regulation by Australian Securities and Investments Commission. Investors may be unable to get some or all of their money back when the investor expects or at all and any investment of the Fund are not comparable to investments with banks, finance companies or fund managers. The Fund’s identification statement may be viewed at https://parracatholic.org or by contacting the Fund. The Fund does not hold an Australian Financial Services Licence.